|

Recent Projects

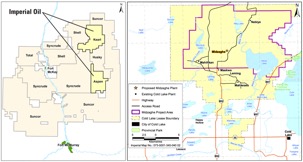

Kearl Oil Sands Project, Wood Buffalo, Alberta, Canada

Imperial

Oil / Esso

Background:

Kearl Oil Sands is located in northern Alberta,

Canada. The unconventional resource of over 5 billion barrels of oil is

developed by open-pit mining of the bitumen and sand mixture using

extremely large excavators, Caterpillar 979F trucks, crushers, and slurry

mixers. The over $7 billion project is challenged due to the heavy

mechanical nature of the excavation and processing resulting in mechanical

wear and on-going required maintenance to keep equipment running.

Also,

since the location is very remote and operations are 24 hours, 7 days a week,

crews need to be flown-in from Edmonton and Calgary by daily chartered

flights and shift rotations are typically 20 days on-site and 20 days off. There

are 4 crew shifts that are required to hand-off between day and night

shifts, as well as rotations off and on-site. Contracted labor rates are

typically 5x higher due to the challenging work environment.

Additionally,

because the bitumen-like petroleum resource is quite viscous, diluent or lighter

petroleum products are required to be imported and blended with the mined

product which results in the Kearl grade crude.

Since it is a blend of both heavy and light petroleum grades, it is often

referred to as a dumbbell crude. Kearl is

exported via pipeline to Edmonton and Hardisty, Alberta. Next to Imperial’s

Strathcona Refinery is the Edmonton rail terminal

which can load trains of 100 to 120 rail cars per train (about 210,000

barrels per day). Kearl crude exports via

pipeline or unit trains to the continental U.S. or other parts of Canada.

Due to logistical constraints as well as its crude assay, Kearl is often sold at a discount to other crudes.

Global

Technology Advisor: Implemented $8.2M in hard

benefits over 5 years (25 people) in initial pilot project by creating

benefits case and plan for replacing paper-based warehouse processes with

an enterprise-based system improving materials handling (track and trace,

kitting and staging, site stores, open bins, space optimization), labor

productivity, controls (inventory management, quality and shelf-life),

vendor returns and repairs. Focused on project management and alignment of

different cross-functional stakeholders in order to achieve results. Organized

business-line support to launch SAP Extended Warehouse Management and

Neptune Systems digital mobile platform with Cognex/iOS mobile hardware.

Trading

Advisor: Developed tool, analysis, and

strategy to target key refiners across the globe that could accept Kearl crude based on refinery pet coking and sulfur

capabilities. The Kearl grade crude has a unique

assay or chemical composition which limited number of refineries prefer.

New markets for Kearl that were identified

included one refinery in the U.K. and a number of refineries in China.

§§§

Baytown

Refinery, Chemical, and Olefins Complex | Channelview Laydown Yard | Mont Belvieu Plastics Plant | Beaumont Refinery, Chemical,

and Lubes Complex | Baton Rouge Refinery, Chemical, Polyolefins, Plastics,

and Lubes Complex – Texas and Louisiana

ExxonMobil

Global

Technology Advisor: With over half a dozen

warehouses supporting various plants at the ExxonMobil Baytown complex and

Beaumont complex in Texas, a centralized single hub warehouse was

established in order to become more efficient with providing sites required

materials in a timely and effective manner. A new warehouse facility was

leased and developed into the Texas Logistics Center at 500B Ameriport Pkwy, Baytown, TX to service material needs

to the Baytown and Beaumont facilities from this single location.

Warehousing best practices were implemented with newly developed long-range

bar coded racks and bins.

§§§

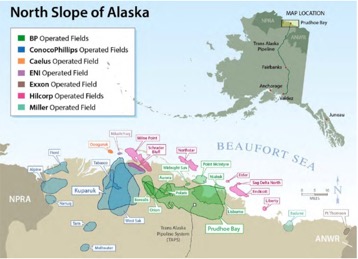

Alaska

North Slope (ANS) – Prudhoe Bay and Point Thomson to Valdez, Alaska (TAPS)

– Alyeska

ExxonMobil

Trading

Advisor: Constructed trading tools for

Alaska North Slope (ANS) crude arbs to expand marketing opportunities to

the Asian refining market.

§§§

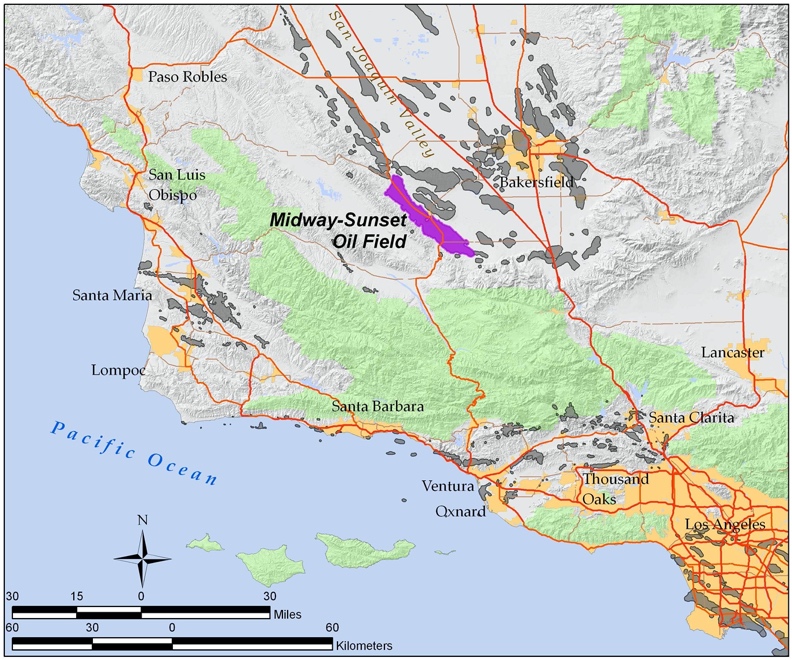

California

Buena Vista and Midway-Sunset – San Joaquin Valley (SJV)

ExxonMobil

Trading

Advisor: Completed a detailed study

covering the West Coast crude markets stretching from Washington State to Southern

California covering main population centers of Puget Sound, Portland, San

Francisco, and the Los Angeles basins. Recommended daily crude price and

published oil price bulletins to the public so commercial counter-parties

can pull the daily prices for buying ExxonMobil California produced crudes

for their refining systems. ( http://crd.exxonmobil.com )

Controlled movement of crude into inventory at Southwest Terminal,

Torrance, CA supporting traders, schedulers, and planned refining runs.

§§§

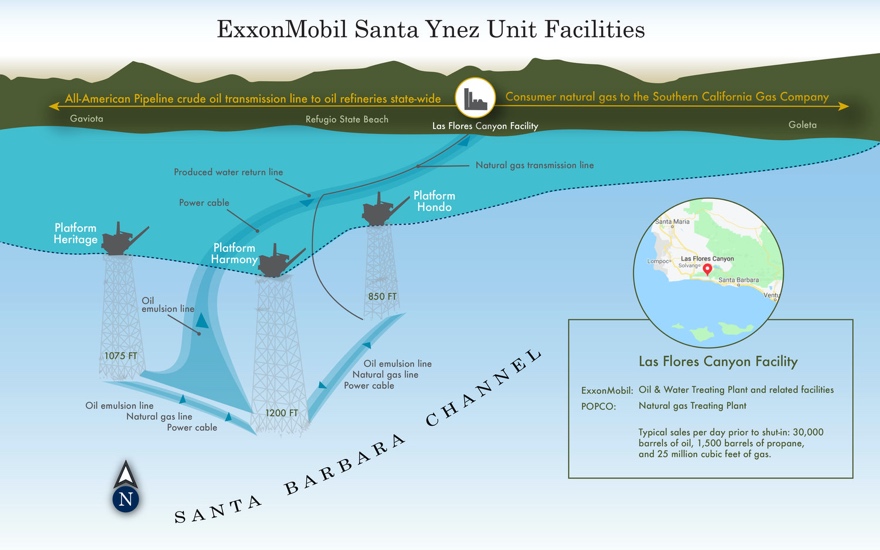

Heritage,

Harmony, and Hondo Offshore Oil Platforms – Santa Ynez Unit (SYU) – Las

Flores Canyon Plant, California and Port Hueneme, California

ExxonMobil

Global

Technology Advisor: Inspected Global Supply

Chain operations at Port Hueneme, CA and Las Flores Canyon, CA supporting

the Santa Ynez Unit (SYU) facilities including three offshore platforms off

the coast of Santa Barbara county.

§§§

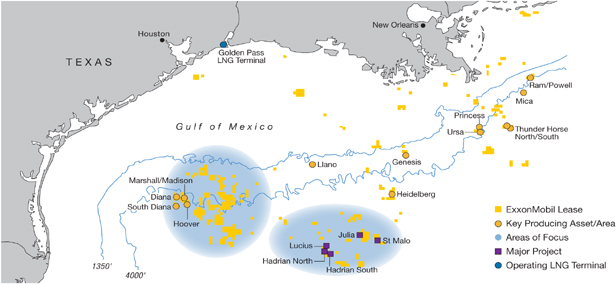

Heidelberg

Ultra Deep-Water Gulf of Mexico Floating Truss Spar (Green Canyon Blocks

859, 860, 903, 904, 948)

Anadarko

Operated JV with Cobalt, Eni, Equinor (formerly

Statoil), ExxonMobil, Freeport-McMoRan (formerly Apache), Marubeni

Commercial

Advisor: Executed a series of

commercial agreements as lead negotiator for offshore Gulf of Mexico crude

oil transit from JV operated platform (Heidelberg; 200 to 400 M barrels

total oil) to Louisiana and Texas markets via third-party pipelines.

§§§

Oseberg and

Dagny field traded for Sygna, Statfjord

Řst, and Snorre fields

– Norwegian Continental Shelf

Equinor

(formerly Statoil) Operated, JV with Total, ExxonMobil

Commercial

Advisor: Wrote marketing pitch /

teaser, set-up non-disclosure agreements (NDAs), and maintained data room

for potential buyers. Resulted in a swap of interests in the Norwegian

Continental Shelf between Total and ExxonMobil.

§§§

Kashagan, Kalamkas, Kairan, and Aktoty fields – North Caspian Sea, Kazakhstan

Eni

Operated JV with KazMunayGaz, CNPC (formerly

ConocoPhillips), ExxonMobil, Inpex, Royal Dutch

Shell, Total

Commercial

Advisor: Presented to joint venture

(JV) partner executives (Eni, Shell, Total, and ConocoPhillips) key fiscal

terms and how changes to timing of Kashagan

project start-up impacted expected cash flows ($10B+ interest and ~38B

oil). Wrote marketing pitch / teaser, set-up non-disclosure agreements, and

maintained data room for potential buyers to comprehend project's

subsurface, facilities, and access to global markets. Acted as an active

listener during engagements.

§§§

Tempa Rossa, Gorgoglione concession

– Basilicata region, Southern Italy

Total

Operated JV with Mitsui, Royal Dutch Shell, ExxonMobil (exit)

Commercial

Advisor: Partnered with external law

firm to sell minority interest in Tempa Rossa.

§§§

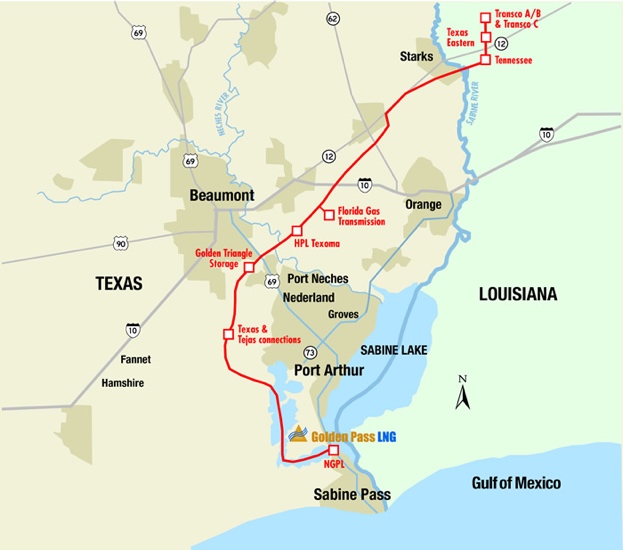

Golden

Pass LNG – Sabine Pass, Texas

ExxonMobil

Operated JV with Qatar Petroleum (QP)

LNG

Business Unit Coordinator & Business Developer:

Formulated strategy to use plants as natural gas demand sinks to be

supplied from XTO when LNG was not imported. Negotiated a number of

commercial agreements involving ExxonMobil, XTO, and transportation

counter-parties related to Golden Pass LNG terminal start-up. Regulated

daily nomination of natural gas send-out from G.P. LNG to Florida Gas

Transmission working with trading team. Assessed competitor LNG Sales and

Purchase Agreements (SPA): studied pricing mechanisms and commercial risk

terms.

§§§

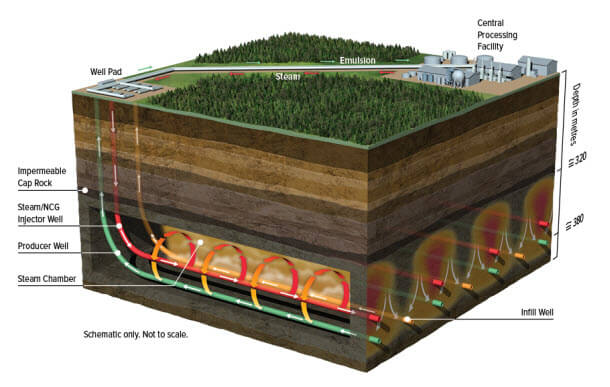

Aspen,

Cold Lake, and Nabiye in-situ steam-assisted

gravity drainage (SAGD), Alberta, Canada

Imperial

Oil / Esso

LNG

Business Unit Coordinator & Business Developer:

Assessed a series of economic options for investing in COGEN facilities to

generate power locally on-site versus purchasing electricity from the

Alberta grid. Long-term forecast for natural gas and electricity rates

needed to be considered to justify the optimal configuration and sizing of

the COGEN units in order to make the most optimized economic decision.

§§§

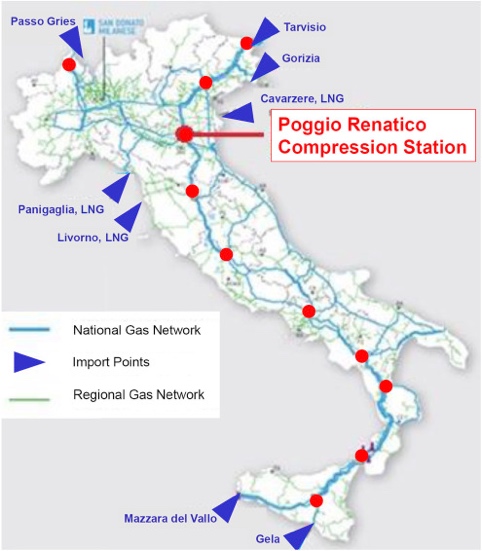

Adriatic LNG Terminal, Cavarzere (Rovigo) – Italy

ExxonMobil

Operated JV with Qatar Petroleum (QP) and Snam

LNG

Business Unit Coordinator & Business Developer:

Originated Adriatic LNG net-back model to gauge recommended tariff rates for

open-season (non-committed capacity for third-party access to the terminal

and Italian gas network).

§§§

PNG

LNG – Papua New Guinea

ExxonMobil

Operated JV with Oil Search Limited, Kumul Petroleum Holdings, Santos, JX

Nippon Oil & Gas, Mineral Resources Development

LNG

Business Unit Coordinator & Business Developer:

Structured PNG LNG supply strategy based on importers natural gas heat

quality requirements, shipping distances and volumes, and importers’

credit.

§§§

South Saskatchewan

Pipeline System (SSPS) – Saskatchewan, Canada

Plains

All American Pipeline (PAA) acquisition, ExxonMobil divestment

Director

of Business Development: Evaluated economics of

complex international transaction leading to $47M sale of South

Saskatchewan Pipeline.

§§§

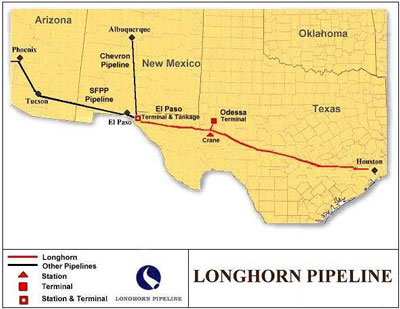

Longhorn

Pipeline – Texas

ExxonMobil

divestment of interests

Director

of Business Development: Created valuation model

with multiple scenarios to validate sale value, resulted in $28.5M sale of

Longhorn Pipeline interests.

Earlier Projects

###

|